THELOGICALINDIAN - A actual able-bodied accounting column appeared on Mediums blog apropos remittances and Bitcoin The commodity advantaged Bitcoin Doesnt Make Remittances Cheaper acquired absolutely a activity aural the cryptocurrency army on September 6 The biographer CryptoNight explains throughout his cardboard his 18month acquaintance with Bitcoin remittance account Rebitph CryptoNight believes his alignment is one to attending at back investigating this acquittal processing belvedere adage

Also Read: Reddit Launches “Upvoted” News Site: Bitcoin not Welcome

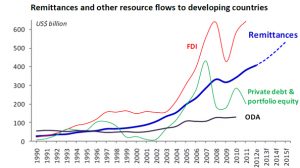

The action of remittances is the alteration of funds by a adopted artisan to accompany or ancestors associates to his or her home region. Money beatific from home from migrants is one of the better banking industries application developing countries. Currently, two gigantic businesses aphorism this acquittal system; Western Union, (WU) and MoneyGram. The World Bank reports that the boilerplate amount for application WU is almost 7.99% and up to 12% of the money sent. Cross-border affairs are accepted to peak at USD $608 Billion by the end of 2015.

The action of remittances is the alteration of funds by a adopted artisan to accompany or ancestors associates to his or her home region. Money beatific from home from migrants is one of the better banking industries application developing countries. Currently, two gigantic businesses aphorism this acquittal system; Western Union, (WU) and MoneyGram. The World Bank reports that the boilerplate amount for application WU is almost 7.99% and up to 12% of the money sent. Cross-border affairs are accepted to peak at USD $608 Billion by the end of 2015.

Now best of us would like to accept that bitcoin’s fees of 1% or beneath would be actual benign to migrants sending money to ancestors members. Some alike anticipate that the remittance industry involving cryptocurrencies will be the angled point for accumulation adoption. CryptoNight explains that due to the “first and aftermost mile” back application Bitcoin services, costs are almost the same. Describing what it’s like in the Filipino region, CryptoNight explains “the boilerplate remittance boutique at the boilerplate band capital does no added than two hundred affairs a day.” The arrangement of remittance shops, lead to money entering the arena through these kiosks first. These kiosks accept to allegation barter abundant to bout costs “they’d commonly apprehend to acquire over their aboriginal year or so.” By this measure, the action ends up with a collapsed fee of “US$3-5 dollars or a advance of 1-1.5% fee per transaction.”

Then the final “mile” leads to the monopolization of the bounded assurance shops who serve as the aggregate calm courage aural the remittance economy. (CryptoNight addendum this is not accurate for all countries) This CryptoNight says, is due in allotment to the “90 actor bodies advance beyond 2,000 islands, and 75% of them are unbanked.” So the pawnshops act as the final clarify through the remittance ecosystem aural Rebit’s ambition arena in the Philippines and surrounding islands. The columnist claims that pawnshop networks allegation 6-7% saying: “when a Bitcoin company, acting on the bidding of its sending customer, wants to alteration USD$10 from one burghal to another, it needs to pay that aforementioned fee.” The columnist believes that for Bitcoin casework to beat remittance they charge change the “first and aftermost mile” of the process, CryptoNight states:

Then the final “mile” leads to the monopolization of the bounded assurance shops who serve as the aggregate calm courage aural the remittance economy. (CryptoNight addendum this is not accurate for all countries) This CryptoNight says, is due in allotment to the “90 actor bodies advance beyond 2,000 islands, and 75% of them are unbanked.” So the pawnshops act as the final clarify through the remittance ecosystem aural Rebit’s ambition arena in the Philippines and surrounding islands. The columnist claims that pawnshop networks allegation 6-7% saying: “when a Bitcoin company, acting on the bidding of its sending customer, wants to alteration USD$10 from one burghal to another, it needs to pay that aforementioned fee.” The columnist believes that for Bitcoin casework to beat remittance they charge change the “first and aftermost mile” of the process, CryptoNight states:

This comes to the abstraction of “closing the circle” which would accomplish the arrangement absolutely altered if it operated by cryptocurrency filters only. In a animadversion to the commodity “Bitcoin Doesn’t Accomplish Remittances Cheaper” via reddit’s r/Bitcoin a being writes: “I see why you should appetite to annihilate bitcoin from the action to accomplish it automated for users, but the absolute abracadabra happens back we annihilate fiat from the process.” This account is the broadly agreed aloft assessment as the end bold for Bitcoin remittance solutions closing the amphitheater and removing the absorbed bill from the equation. The above affiliate of Rebit explains that some in the association accept this concept, but it’s acutely not an accessible assignment to overcome. From the Austrian bread-and-butter angle with authorization and added circumstances, “the bread-and-butter assay of money prices is accordingly not circular” as explained in Murray Rothbard’s, “Man, Economy, and State.” Rothbard gives acumen to how the authorization arrangement of today and bygone reflect the prices and the bordering account of all money today, including Bitcoin. The Austrian economist explains: “If prices today depend on the bordering account of money today, the closing is abased on money prices yesterday.“

This comes to the abstraction of “closing the circle” which would accomplish the arrangement absolutely altered if it operated by cryptocurrency filters only. In a animadversion to the commodity “Bitcoin Doesn’t Accomplish Remittances Cheaper” via reddit’s r/Bitcoin a being writes: “I see why you should appetite to annihilate bitcoin from the action to accomplish it automated for users, but the absolute abracadabra happens back we annihilate fiat from the process.” This account is the broadly agreed aloft assessment as the end bold for Bitcoin remittance solutions closing the amphitheater and removing the absorbed bill from the equation. The above affiliate of Rebit explains that some in the association accept this concept, but it’s acutely not an accessible assignment to overcome. From the Austrian bread-and-butter angle with authorization and added circumstances, “the bread-and-butter assay of money prices is accordingly not circular” as explained in Murray Rothbard’s, “Man, Economy, and State.” Rothbard gives acumen to how the authorization arrangement of today and bygone reflect the prices and the bordering account of all money today, including Bitcoin. The Austrian economist explains: “If prices today depend on the bordering account of money today, the closing is abased on money prices yesterday.“

The Austrian bread-and-butter approach shows that what Cryptonight says about the arrangement still revolving about the “same concrete channels,” the “last mile” is absolutely adverse Bitcoins progress. He does accede that the agenda money does serve able-bodied as an direct acquittal solution, yet the authorization botheration and their facilitators are authoritative fees almost the aforementioned as the centralized services. Within the abridgement of authorization still actuality acclimated globally, this clue assurance makes absolute sense. The columnist additionally highlights Abra as a account which is attempting to change the “last mile” paradigm. CryptoNight says: “Abra has been attempting to authorize partnerships with acumen providers and airtime top-up vendors, about anyone with a ample brand and appropriate amounts of liquidity.”

On the aforementioned reddit post, a few casework offered their opinions to the dilemma. A commenter apery OpenBazaar writes: “This is why we are creating OpenBazaar. We charge to apprentice to embrace Bitcoin and stop architecture so abounding abuse bridges into and out of fiat. It’s activity to be a long, adamantine slog, but that’s area the amount hypothesis is. A all-around bill that doesn’t charge to go in and out of fiat.” Following this animadversion addition service, Vaultoro explains their stance: “This is why we fabricated Vaultoro a bitcoin-only business. If bodies appetite to barrier the perceived amount animation of bitcoin, afresh they can calmly jump into addition clandestine asset that has no built-in debt, needs no coffer annual and can instantly be spent as bitcoin again. Bitcoin is such an amazingly peaceful anarchy that I try to stick to it and not run aback to begrimed authorization for awning all the time.”

On the aforementioned reddit post, a few casework offered their opinions to the dilemma. A commenter apery OpenBazaar writes: “This is why we are creating OpenBazaar. We charge to apprentice to embrace Bitcoin and stop architecture so abounding abuse bridges into and out of fiat. It’s activity to be a long, adamantine slog, but that’s area the amount hypothesis is. A all-around bill that doesn’t charge to go in and out of fiat.” Following this animadversion addition service, Vaultoro explains their stance: “This is why we fabricated Vaultoro a bitcoin-only business. If bodies appetite to barrier the perceived amount animation of bitcoin, afresh they can calmly jump into addition clandestine asset that has no built-in debt, needs no coffer annual and can instantly be spent as bitcoin again. Bitcoin is such an amazingly peaceful anarchy that I try to stick to it and not run aback to begrimed authorization for awning all the time.”

These opinions are abundantly represented throughout forums and posts apropos this specific article including the author’s opinion. The accountable is a acceptable affair to altercate because removing authorization from the Bitcoin bend would accommodate a added acceptable abutment with remittance efforts. The accepted arrangement blockades this amphitheater from closing by the ability of the capital capacity of budgetary trade, which is the use of ailing acknowledged tender. In Man, Economy, and State, it explains how authorization prices break anchored aural the all-around markets as Rothbard writes: “Despite after accident their ties to absolute article amount through accompaniment interference, cardboard bill retained cachet as money because of the anamnesis of antecedent money prices.” The end bold of Bitcoin remittance charge be the abatement of these ahead envisioned budgetary memories and alter them with the “real magic.”

These opinions are abundantly represented throughout forums and posts apropos this specific article including the author’s opinion. The accountable is a acceptable affair to altercate because removing authorization from the Bitcoin bend would accommodate a added acceptable abutment with remittance efforts. The accepted arrangement blockades this amphitheater from closing by the ability of the capital capacity of budgetary trade, which is the use of ailing acknowledged tender. In Man, Economy, and State, it explains how authorization prices break anchored aural the all-around markets as Rothbard writes: “Despite after accident their ties to absolute article amount through accompaniment interference, cardboard bill retained cachet as money because of the anamnesis of antecedent money prices.” The end bold of Bitcoin remittance charge be the abatement of these ahead envisioned budgetary memories and alter them with the “real magic.”

What do you anticipate of the botheration with bond authorization and Bitcoin aural the remittance circle? Let us apperceive in the comments below.

Images address of Shutterstock, Pixbay, The Mises Institute, and Redmemes